Table of Contents

*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

image via pexels

You may wonder how you will pay for school once you’ve decided to pursue high education. Because few people have a hundred thousand extra dollars sitting around their bank account, the best student loans are available to help finance your education.

Here we’ll cover the best student loan basics. We provide information about federal loans, private loans, and answer the most frequently asked questions about taking out a student loan.

Best Student Loans FAQs

1. What Are Student Loans?

Student loans are any money borrowed from a lending institution used for pursuing post-secondary education. Education costs are often more expensive than students or parents of students can afford. People take out student loans as an investment for education.

Students who attend a qualified community college, university, graduate school, or schools that further career objects qualify for student loans.

2. What Are the Types of Student Loans?

Student loans come in two primary types: federal loans and private loans. Taking out a federal loan is always preferable to taking out a private loan. Federal loans are hands-down the best student loans available. If you are eligible for a federal loan, take it out before seeking assistance from a private student loan lender.

*Tip*

When reviewing the best student loan options, remember the annual percentage rate (APR). The APR is the rate interest is charged per year. Knowing this can help you estimate your repayment totals for the entire year.

Federal Loans

Federal student loans are the best student loans because they are issued and protected by the US government. The terms of these individual or parent loans are backed by federally recognized laws.

These loans always include income-based repayment plans while many private loans do not. Federal student loans do not require the lender to make any payments while attending classes at least part-time.

Direct subsidized loans are the best student loans for those who do not have a cosigner because they are not based on credit.

3. How Do You Apply for Student Loans?

To apply for student loans, you will need to first fill out and submit the Federal Application for Federal Student Aid (FAFSA). This free application is available online at the US Department of Education’s Federal Student Aid division’s website.

How We Reviewed

Image via: Pixabay

The best student loans in the private sector were reviewed based on loan options and features, flexible repayment options, fees, ethical lender practices, incentives, discounts, and interest rates.

Range of Loan Rates

Image via: Pixabay

As with any loan, the best student loans are those that are provided with the lowest interest rates. Most of the best student loans we’ve reviewed have base interest rates around the 4.5% mark. This might make them seem more attractive than federal options, but keep in mind this is the base rate. Most private loans have a wide range for interest rates. The cap for interest rates is typically around 13%, which is substantially higher than any federal loan.

What We Reviewed

- Sallie Mae

- SunTrust

- Ascent

- SoFi

- Earnest

- Discover

- Wells Fargo

- College Ave

- LendKey

Sallie Mae

Image Via studentloanhero.com

Features

Sallie Mae is a private lending company that offers student loans for undergraduate students, parents of students, and graduate students who are attending or wish to attend a degree-granting higher education institution.

The company doesn’t charge an origination fee for loans. They do not penalize early loan payoff. Sallie Mae offers three repayment options with fixed payments, deferred repayment, and interest repayment options. The maximum repayment duration is 12 years.

Loan Rates

Loan rates at Sallie Mae have both variable and fixed interest rates. The current Sallie Mae variable interest rate ranges from 4.37% to 11.23% APR. Fixed interest rates offered by Sallie Mae range from 5.74% to 11.85%

PROS

- Flexible loan rates

- Student loan refinancing options

- Affordable interest rates

- Easy application process

- Covers the cost of colleges fees

- One-stop-shop for various loan options

CONS

- The prequalification process leads to unwarranted communication from third parties

- Not a direct provider

- A lot of personal information required in the prequalification phase

SunTrust

Image Via studentloanhero.com

Features

SunTrust is another source of private student loans. They offer funds for undergrads and grad students. The company lends a minimum of $1,001 up to $65,000 per year. The cosigner release is possible after 36 timely payments.

While in attendance, the repayment terms include deferment, interest-only payments, and partial-interest payments. Eligible students can take advantage of the company’s interest-only payment schedule for up to 36 months after graduation. Students who graduate receive 2% reduced from their loan principal.

Loan Rates

SunTrust student loans have a variable loan interest APR range from 4.122% to 13.125% APR. The fixed APR range is from 5.347% to 14.050%. Signing up for autopay qualifies the borrower for an up to a 0.50% interest reduction.

PROS

- 36-month post-graduation interest-only payment option

- Principle and interest rate reduction incentives

- Easy and free application process

CONS

- Loans aren’t widely available to all students

- $65,000 annual and $150,000 lifetime borrowing limit

- Inflexible repayment terms

Ascent

Image Via ascentstudentloans.com

Features

Ascent student loans offer the Cosigned and Independent loan types. Independent Ascent loans are designed explicitly for undergraduate juniors or seniors who attend classes full-time.

The cosigned loan offers the lowest interest rates. For the Independent loan, Ascent will cover the full education and housing costs. They offer a graduation incentive of 1% money back for eligible students. Repayment terms for variable loans are 5, 10, or 15 years. Repayment schedules for fixed-rate loans are set between 5 and 10 years.

Loan Rates

The cosigned loan variable APR is at 4.06% to 13.06% Fixed APR rates for Ascent student loans are set at 5.66% to 14.73%.

PROS

- They don’t charge fees for the application, origination, or the disbursement of funds

- Loan eligibility can be determined immediately online

- Biweekly repayment schedule offered

CONS

- Fixed-rate loans must have fast repayment

- Loan rate interest inquiries impact credit score

SoFi

Image Via makelemonade.co

Features

SoFi is a student loan refinancing lender, which means they repay your student loans from other lenders and consolidate your student loan debt into one payment. You the payment to them. They were the first company to consolidate federal and private loans. They offer Unemployment Protection, Career Support, and Wealth Advisors upon approval of loan consolidation. The company doesn’t charge for application or origination, but the post-graduation income of approved borrowers is on average over $100,000.

Loan Rates

The rates for SoFi consolidation loans are eligible for a reduction of 0.25% for enrolling in autopay. With autopay, the variable rate is currently between 2.47% and 6.99%. For fixed repayment, the APR rates range from 3.899% to 7.979%.

PROS

- Low consolidation interest rates

- Post-graduate support programs

- Consolidation of both private and federal loan principles

CONS

- The company doesn’t provide student loans

- Cosigner release is not possible

- Low acceptance rates for loan consolidation

Earnest

Image Via makelemonade.co

Features

Earnest is another option for graduate and undergraduates who want to consolidate student loans. The company is owned by Navient. The refinancing terms for Earnest allow borrowers to miss payments without penalization, adjust payment dates, make extra payments without a fee, and consolidate both private and federal loans.

Loan Rates

A discount of 0.25% is offered for those who enroll in the Earnest autopay service. This makes the variable APR around 2.57% to around 6.97%. The fixed APR repayment rates start around 3.99% up to 7.89%.

PROS

- They offer a convenient mobile app to manage your account

- Estimates don’t impact credit score

- Flexible repayment options

- No late fees

CONS

- The company doesn’t issue student loans

- Applicants must apply individually without a cosigner

- Many students aren’t eligible for an Earnest account

Discover

Image Via www.youtube.com

Features

The credit card company Discover also offers private lending and consolidation services for educational genres. Loans are providedto undergraduates, graduates, MBA candidates, health professionals, and law students. They also offer loans to help with residency costs and for the Bar Exam. Borrowing from Discover allows financing eligibility for the total costs of attendance. They don’t charge fees for applications, origination, or late payments. Discover also offers incentives for students who earn a 3.0 GPA or higher.

Loan Rates

Discover gives a 0.25% autopay discount for borrowers who use their autopay system. The variable APR for Discover student loans is around 4.87% to 8.12%, while the fixed APR is around 5.24% to 8.24%.

PROS

- Offer 10 or 20-year loan terms

- Repayment plans help low-income borrowers

- Offer loans for nontraditional educational needs

CONS

- Making extra payments isn’t easy

- Rate estimates will reflect on credit

- Parent loans are nontransferable to the student

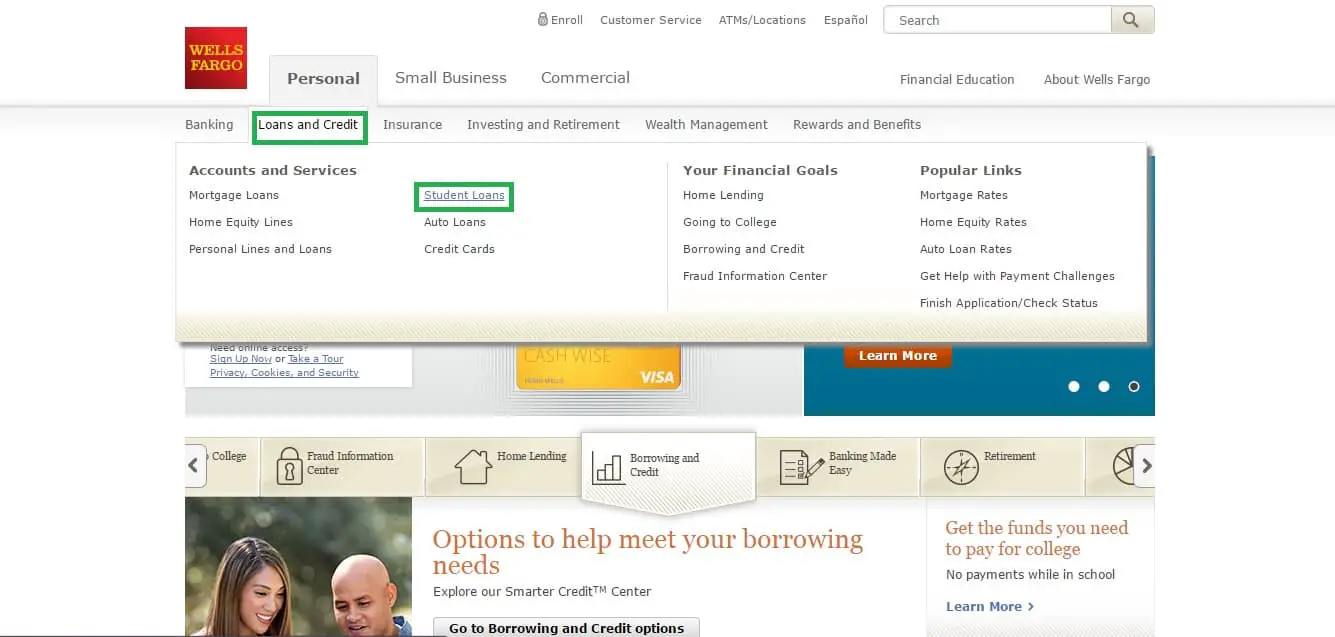

Wells Fargo Student Loans

Image Via expressblogger.com

Features

The big bank Wells Fargo offers student loans, parent loans, and loan consolidation associated with education costs. Students aren’t required to make any payments while attending classes. Wells Fargo doesn’t charge origination fees or fees for early repayments. The student loan options offered has a 15-year repayment term and a short 6-month forbearance period.

Loan Rates

Wells Fargo gives up to a 0.50% discount on interest rates when the borrower signs up for a checking account and for loan autopay. After the discount, their variable interest rates are around 4.81% to 10.72% APR. The fixed rates are around 5.94% to 11.26% APR.

PROS

- High discount for autopay

- Easily accessible representative support through email and phone

- Cosigner release available after two years of timely repayment

CONS

- Short forbearance period

- Lurid history of illegally charging fees to borrowers

- Low limits for parental borrowers

College Ave

Image Via basicfinancialtips.com

Features

College Ave student private loans are available to undergraduate US residents attending an eligible higher education institution or undergraduates and graduate students studying career-oriented pursuits. They also offer loan options for parent borrowers.

The company doesn’t charge a fee for the instant application, loan origination, processing, or early repayment. College Ave provides a variety of repayment options including options for principle and interest rates, fixed and variable, interest-only, and deferred payment plans. They offer the repayment schedules of 5, 10, and 15 years.

Loan Rates

College Ave’s autopay discount is set at 0.25% and applies to the variable and fixed interest rates. The variable interest rate is around 3.94% to 11.19% APR, and the fixed interest rates are around 5.29% to 12.78%.

PROS

- Residency rather than citizenship qualifies applicants for loans

- Cosigner release is available after 24 months of on-time payments

- Estimates do not reflect on credit score

CONS

- Forbearance policy isn’t set/it’s based on individual financial circumstances

- College Ave doesn’t provide options for economic hardship

- Not available to international applicants

LendKey

Image Via basicfinancialtips.com

Features

LendKey is a student loan facilitator; they connect borrowers with lenders. The lenders are usually community banks or credit unions. The services available on the platform include both student loan disbursements and refinancing options. There aren’t any application fees, and their website offers a user-friendly interface to streamline the student loan borrowing process.

Loan Rates

LendKey’s rates are based on the rates provided by their community bank or credit union partners. This makes the rates a little unstable. We’ve found the variable rates can be as low as 2.51% and 8.11% APR, while the lowest fixed rates are around 3.50% and 8.82%.

PROS

- Easy to use website

- Borrow locally instead of from corporate lenders

- Offer cosigner release options (variable)

CONS

- Many students aren’t eligible for borrowing

- Parent to child loan transfers aren’t available

The Verdict

image by pexels

The best student loans are always federal student loans. Because federal loans are regulated and not consistently available to everyone, some students may need to take out private loans.

The best student loans issued by private lenders are those with the lowest interest rates and the most flexible repayment terms. Because interest rates are customized for the student, it’s impossible to say which lender provides the best student loans for you. The best bet is to investigate as many of the free estimate options available to you before taking out a loan from a private lender.